$2.5 Trillion Mineral Wealth Anchors Supply Chain Ambitions

Saudi Arabia’s mineral reserves, valued at over $2.5 trillion, form the backbone of its economic diversification strategy. With more than 45 identified minerals including gold, phosphate, lithium, and rare earth elements, the Kingdom is positioning mining as the third pillar of its economy. The Saudi Mineral Supply Chain is designed not only to monetize these resources but also to integrate them into global trade networks, ensuring resilience and long-term growth.

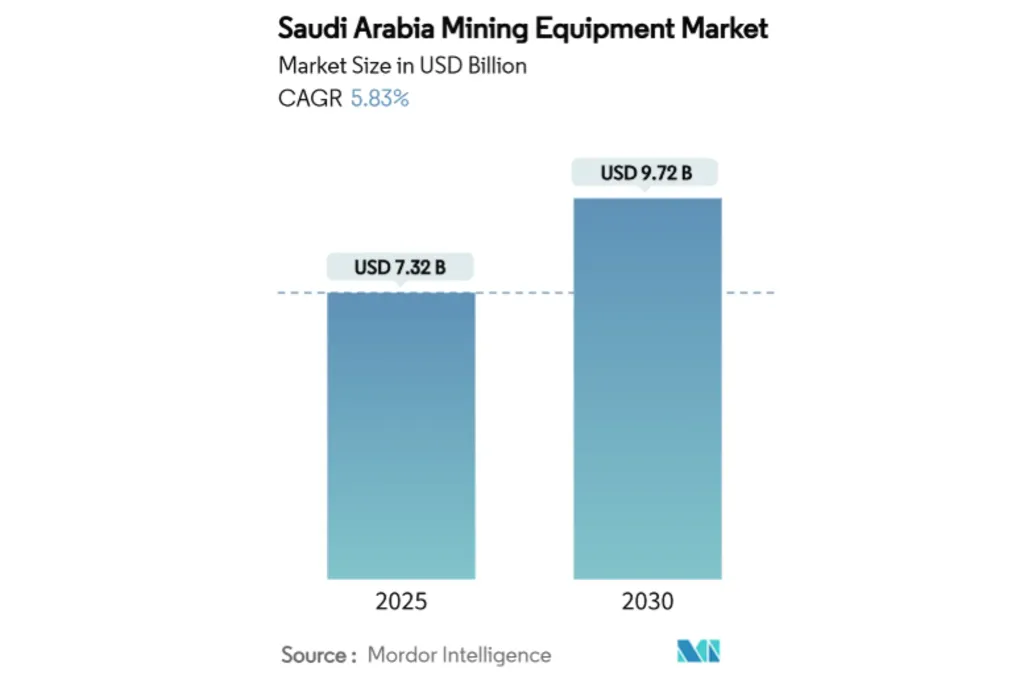

Mining Equipment Market to Reach $9.72 Billion by 2030

The Saudi Mineral Supply Chain is closely tied to the mining equipment market, which is projected to grow from USD 7.32 billion in 2025 to USD 9.72 billion by 2030 at a CAGR of 5.83%. This expansion reflects Vision 2030’s push for industrial localization, electric fleet incentives, and predictive maintenance corridors. Surface mining support equipment held 21.36% of market share in 2024, while drills and breakers are expected to grow at 6.17% CAGR. Battery-electric equipment, though currently small, is forecasted to surge at 16.31% CAGR, reshaping fleet composition and lowering ownership costs.

Privatization Unlocks $9.32 Billion in Mining Deals

Private concessions under Vision 2030 have transformed procurement dynamics within the Saudi Mineral Supply Chain. In 2025 alone, 33 new mining licenses were issued, supported by a USD 182 million exploration incentive fund. Ma’aden’s USD 1.25 billion sukuk issuance highlights strong capital availability, while nine deals worth USD 9.32 billion underscore investor confidence. International entrants such as Vedanta and Zijin demand digital-ready machines that meet global emissions standards, accelerating orders for autonomous drills and sensor-rich loaders.

Exploration Programs Cover 12,012 km² of Arabian Shield

The Exploration Enablement Program has opened 4,000 km² of greenfield targets, requiring advanced rigs and geochemistry labs. Ma’aden’s partnership with Fleet Space Technologies spans 12,012.6 km² of the Arabian Shield, using satellite-based tomography to map sub-surface mineral potential. This exploration pipeline ensures a steady demand curve for high-spec drilling equipment, reinforcing the Saudi Mineral Supply Chain with continuous resource definition and bulk-sampling operations.

Battery-Metal Refineries Target 2027 Start-Up

Lithium extraction from produced water, pioneered by Aramco and Ma’aden, is catalyzing industrial-scale refineries. Partnerships such as Critical Metals Corp with Obeikan Group to produce lithium hydroxide highlight the Kingdom’s ambition to rival China in battery-grade output. The Saudi Mineral Supply Chain now requires autoclaves, hydrometallurgical reactors, and nano-filtration presses, alongside premium quality-control instruments like ICP-MS analyzers. These investments in controlled-atmosphere calcination lines and solvent-extraction systems elevate the value mix of mining equipment procurement.

Local-Content Quotas Reshape Supply Chain Sourcing

Saudi Arabia’s IKTVA benchmark of 70% local sourcing now extends to mining projects, compelling OEMs to assemble or subcontract within the Kingdom. By late 2025, over 350 multinational firms had secured regional headquarters licenses, accelerating plant construction in Jubail and Ras Al Khair. This localization drive stabilizes the Saudi Mineral Supply Chain by ensuring that globally branded machines integrate Saudi-built frames, cabins, and control modules. Preferential loans and penalty tariffs further tilt the competitive field toward firms investing in domestic capacity.

Supply Chain Resilience Anchored by $144 Billion Investments

Saudi Arabia’s Global Supply Chain Resilience Initiative (GSCRI) complements mining by attracting $10 billion in strategic investments within two years, supported by $2 billion in incentives. Already, $144 billion in foreign and joint industrial investments have been secured, strengthening the Saudi Mineral Supply Chain’s role in global trade. By aligning mining, manufacturing, and advanced technologies, the Kingdom is building a foundation for Industry 5.0 — where human creativity blends with automation to deliver sustainable growth.

Also Read: Unlocking Saudi Arabia’s Mining Potential: Key Sectors and Global Demand

Frequently Asked Questions (FAQ) on the Saudi Mineral Supply Chain

1. What is the Saudi Mineral Supply Chain?

The Saudi Mineral Supply Chain refers to the integrated system of mining, processing, and distribution of Saudi Arabia’s $2.5 trillion mineral wealth. It connects local production with global markets while ensuring resilience, sustainability, and industrial localization under Vision 2030.

2. How does Vision 2030 impact the Saudi Mineral Supply Chain?

Vision 2030 positions mining as the third pillar of the national economy. Through privatization, new mining laws, and incentives, the Saudi Mineral Supply Chain is being modernized to attract foreign investment, create jobs, and reduce reliance on oil.

3. What role does equipment investment play in the Saudi Mineral Supply Chain?

The mining equipment market is projected to grow from USD 7.32 billion in 2025 to USD 9.72 billion by 2030. This growth supports the Saudi Mineral Supply Chain by enabling advanced drilling, battery-electric fleets, and predictive maintenance technologies that improve efficiency and reduce costs.

4. Why are local-content quotas important for the Saudi Mineral Supply Chain?

Mandatory local-content quotas, such as the 70% IKTVA benchmark, ensure that multinational firms manufacture or assemble equipment within Saudi Arabia. This strengthens the Saudi Mineral Supply Chain by boosting domestic value addition, reducing import reliance, and creating long-term industrial capacity.

5. How does Saudi Arabia plan to compete in battery metals?

Saudi Arabia is investing in lithium and rare earth projects, with refineries expected to start by 2027. These facilities will supply critical inputs for global battery production, positioning the Saudi Mineral Supply Chain as a competitive hub for future technologies.