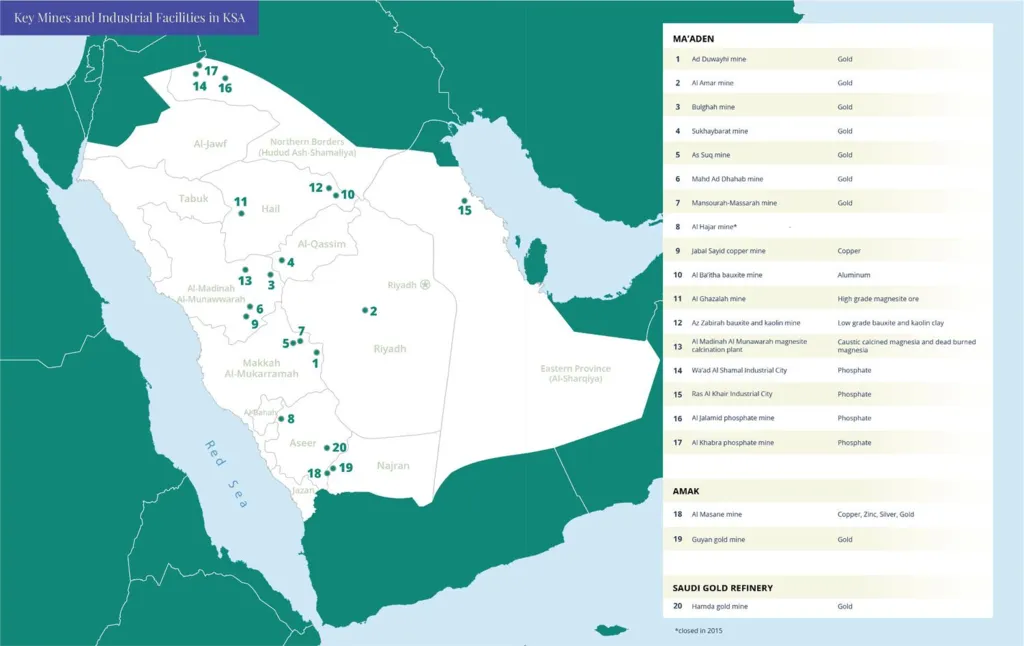

Saudi Arabia’s push into mining is accelerating fast, and Saudi mining licenses 2025 sit at the center of this shift. The Kingdom is unlocking new gold, copper, and zinc zones across the Arabian Shield while rapidly expanding its phosphate industry to meet growing global fertilizer demand. These two tracks—minerals and fertilizers—define the country’s strategy as it pivots deeper into resource-based industrialization.

Rapid Saudi Mining Licenses 2025 & Phosphate Growth

In the first half of 2025, Saudi Arabia issued 22 new mining exploitation licenses, a 144% increase from the previous year. These licenses attracted SR134 million ($35.7 million) across 47 sq km and expanded total active permits to 2,403, including 612 exploration and 236 exploitation licenses.

Exploration now focuses heavily on the Arabian Shield, following new survey data covering 400,000 sq km. At the same time, the Kingdom plans to triple phosphate production by 2040 through a $15 billion expansion, supported by a new $922 million processing project adding 3 million tonnes annually.

Saudi Mining Licenses 2025 & the 90-Day Fast Track

A major reason for the surge in activity is regulatory reform. The new mining law cut approval times dramatically. What once took 18-24 months now moves forward in 90 days using digital licensing systems. Most mining approvals can now be secured within 180 days, while industrial licenses take 30-90 days.

This has opened the door for explorers targeting high-value metals across the Shield. In December 2025, bidding began for 13,000 sq km of new exploration areas across Madinah, Makkah, Riyadh, Qassim, and Hail.

Read Also: Arabian Shield Exploration Accelerates With 90-Day Shift

Global Partnerships: Barrick & International Investors

Partnerships with global miners are growing. Barrick Gold expanded its joint ventures with Ma’aden to include Jabal Sayid South and Umm Ad Damar, building on their 50/50 partnership at the Jabal Sayid copper-gold mine.

Meanwhile, new exploration momentum is reinforced by discoveries such as the 11 million tonnes of copper, zinc, gold, and silver found in Najran—evidence of how vast the Shield’s resource base is.

Read Also: Saudi Vision 2030 Mining Partnership: Global Alliances and Local Growth

Downstream Focus: EV Batteries From Local Minerals

Saudi Arabia is not stopping at extraction. The Kingdom wants to produce the materials needed for next-generation industries. Investments of $25–30 billion target battery minerals, including lithium, with a goal of producing 500,000 EV batteries by 2030.

The Aramco–Ma’aden joint venture aims to begin commercial lithium extraction by 2027 using advanced direct-extraction technology. The EV battery recycling market—already $155 million—supports the full supply chain and reduces import dependence.

Read Also: Saudi Lithium & Battery Mining: Powering the Kingdom’s EV Ambitions

Strategic Outlook for Saudi Mining Licenses 2025 and Beyond

The rapid expansion of Saudi mining licenses 2025 signals a clear shift toward a diversified, mineral-driven economy. Investors who want deeper insights into licensing, industrial downstream opportunities, or market-entry strategies can explore more services from Saudi Arabia Mining by Eurogroup Consulting. With 40 years of experience and a strong focus on market research in the Kingdom, Eurogroup Consulting provides unmatched insights for businesses looking to succeed in fast-changing environments.