Silica sand mining Saudi Arabia is no longer just about digging raw material out of the ground. It has become a strategic industry tied directly to solar power, semiconductors, and industrial growth. The kingdom holds over 1 billion tons of high-purity silica sand, with purity levels above 98%, placing it among the most valuable reserves in the world. As Saudi Arabia expands solar panel production and plans for advanced chip manufacturing, silica is emerging as the new industrial gold.

Executive Summary: Why High-Purity Silica Is the New Gold

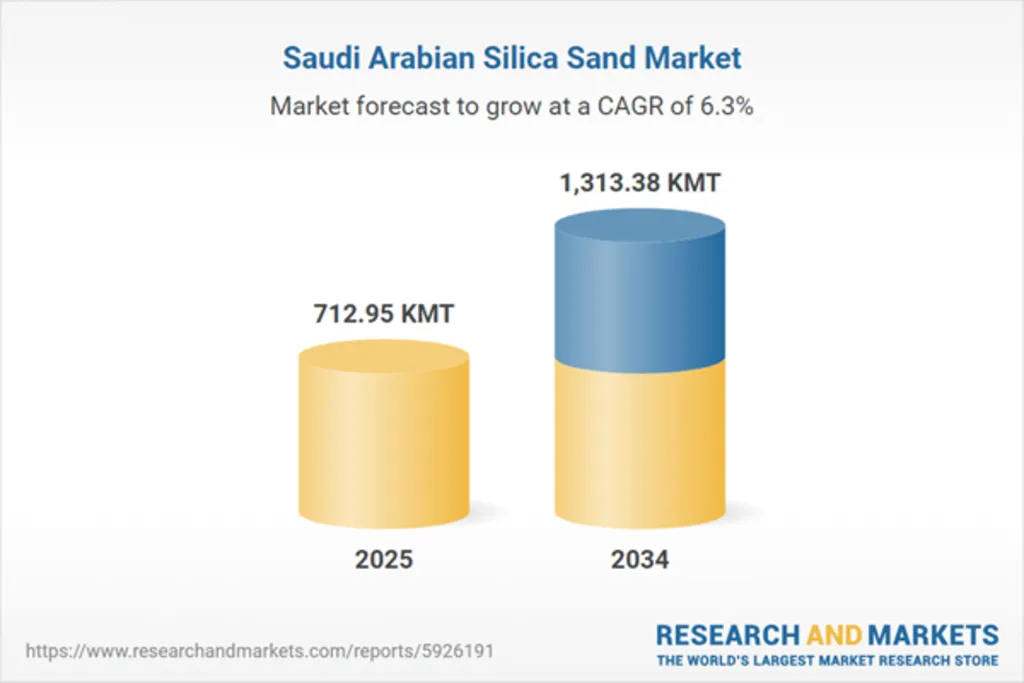

Saudi Arabia’s silica advantage lies not only in volume, but in purity. High-purity silica sand is essential for glass, photovoltaic cells, and semiconductor wafers. With Vision 2030 pushing local manufacturing and clean energy, this resource is gaining strategic importance. The country’s silica sand market reached 757.87 thousand metric tons in 2025 and is projected to grow at a 6.30% CAGR to 1,396.13 KMT by 2035. This growth reflects rising demand from energy and construction, but also from higher-value industries.

Silica Sand Mining Saudi Arabia and the Solar Supply Chain

Solar energy is one of the strongest drivers behind silica demand. From 2022 to early 2024, Saudi Arabia added 2.1 gigawatts of renewable capacity, a 300% increase from previous years. High-purity silica sand is a core input for photovoltaic cells used in solar panels. Without it, solar manufacturing cannot scale. This makes silica not just a raw material, but a foundation for the kingdom’s energy transition.

Beyond Solar: Silica Sand Mining Saudi Arabia and Energy Extraction

Silica also plays a critical role in semiconductor production. Silicon dioxide forms the base of chips used in electronics, data centers, and industrial systems. As global demand for chips rises, so does the need for ultra-pure silica. At the same time, Saudi Arabia’s Jafurah gas field, holding 229 trillion cubic feet of raw gas resources, increases demand for silica sand as proppant in energy extraction. These parallel uses strengthen silica’s position across multiple supply chains.

Read Also: Saudi Lithium Extraction Technologies: Brine is The New White Oil

The Shift From Extraction to Local Purification

A major shift is now underway. Investment is moving from simple extraction toward local purification and processing. Purified silica is required for glass manufacturing and high-tech uses, and processing it domestically reduces reliance on imports. New mining licenses, including a 20-year permit for a 9.6 million square meter high-percentage silica site in Riyadh, signal this change. Companies are focusing less on volume and more on value.

Why Location and Infrastructure Matter

Most of Saudi Arabia’s high-purity silica reserves are concentrated near Jeddah’s glass manufacturing hub. This proximity allows faster processing, lower transport costs, and direct integration into industrial supply chains. It also supports advanced applications, from solar panels to high-tech glass, making silica mining a key part of Saudi Arabia’s industrial ecosystem.

Read Also: Saudi Mining Licenses 2025 Ignite a Mineral Awakening

A Strategic Path Forward for Silica Sand Mining Saudi Arabia

The silica sand mining in Saudi Arabia is entering a new phase. The focus is no longer just on what is extracted, but on how it is refined, used, and linked to future industries. For companies seeking deeper insight into Silica sand mining Saudi Arabia, Saudi Arabia Mining by Eurogroup Consulting offers strategic consulting backed by 40 years of distinguished experience, with a strong focus on market research in the region. Our team delivers the insights needed to succeed in Saudi Arabia’s rapidly evolving industrial landscape.