$2.5 Trillion in Reserves Powering Saudi Critical Minerals Exploration

Beneath Saudi Arabia’s vast deserts and ancient rock formations lies a trove of untapped potential—an estimated $2.5 trillion in critical mineral reserves. Lithium, copper, nickel, rare earth elements, and phosphate now shape a new frontier, fueling ambitions far beyond hydrocarbons. These resources, vital to electric vehicles, renewable energy grids, and advanced electronics are central to the Kingdom’s transformation.

The Arabian Shield, a geological formation spanning over 600,000 km², is the centerpiece of Saudi Critical Minerals Exploration. This region hosts over 48 identified minerals, and recent discoveries have significantly upgraded the country’s resource estimates. From gold deposits near Mansourah-Massarah to lithium-rich brines in Aramco’s oil fields, Saudi Arabia is positioning itself as a strategic supplier for the energy transition.

Billion Dollars Investment Strategy Under Vision 2030

Under Saudi Vision 2030, mining is designated as the third pillar of the national economy, alongside oil and petrochemicals. The Ministry of Industry and Mineral Resources has committed SAR 375 billion (~$100 billion) in mining investments by 2035, with SAR 75 billion already allocated to active projects.

Key reforms include:

- A new Mining Investment Law that slashes tax rates from 45% to 20%

- Streamlined licensing processes

- Co-financing incentives covering up to 75% of CAPEX for advanced exploration

Saudi Critical Minerals Exploration spending has surged by 32% annually—outpacing the global average. The government has also launched the Regional Geological Survey (RGP), one of the largest of its kind, to map mineral potential across the Arabian Shield.

49 Projects and Strategic JVs Driving Saudi Critical Minerals Exploration

As of 2025, 49 projects have qualified under the Mining Exploration Empowerment Program, covering over 4,000 km². These include diamond and rotary drilling campaigns worth SAR 179 million ($47.7 million), plus SAR 12 million ($3.2 million) in geophysical surveys.

Notable ventures:

- Aramco and Ma’aden’s lithium JV, targeting commercial production by 2027

- Tinka Resources’ gold exploration at Huwaymidan, with trench samples showing up to 10 g/t Au

- Manara Minerals (a PIF-Ma’aden JV) acquiring a 10% stake in Vale Base Metals, gaining access to global copper and nickel assets

These projects reflect a shift from oil-centric development to diversified mineral supply chains. Saudi Critical Minerals Exploration is now a magnet for foreign investment, with companies from Canada, China, and Australia actively participating in licensing rounds.

Global EV and Energy Demand Fueling Saudi Critical Minerals Exploration

The global race for critical minerals is intensifying. According to the IEA’s 2025 Outlook, lithium demand rose 30% in 2024 alone, while nickel, cobalt, and rare earths saw 6–8% growth. The energy sector now accounts for 85% of demand growth for battery metals.

Saudi Arabia’s strategic advantage lies in timing and geography. As China and Indonesia dominate refining, Saudi Arabia offers a geopolitically neutral alternative with access to European, African, and Asian markets. Its proximity to global shipping lanes and robust infrastructure (ranked #1 in road connectivity) enhances its export potential.

Moreover, giga-projects like NEOM and Qiddiya are driving domestic demand for copper, aluminum, and phosphate—creating a virtuous cycle of extraction, processing, and consumption.

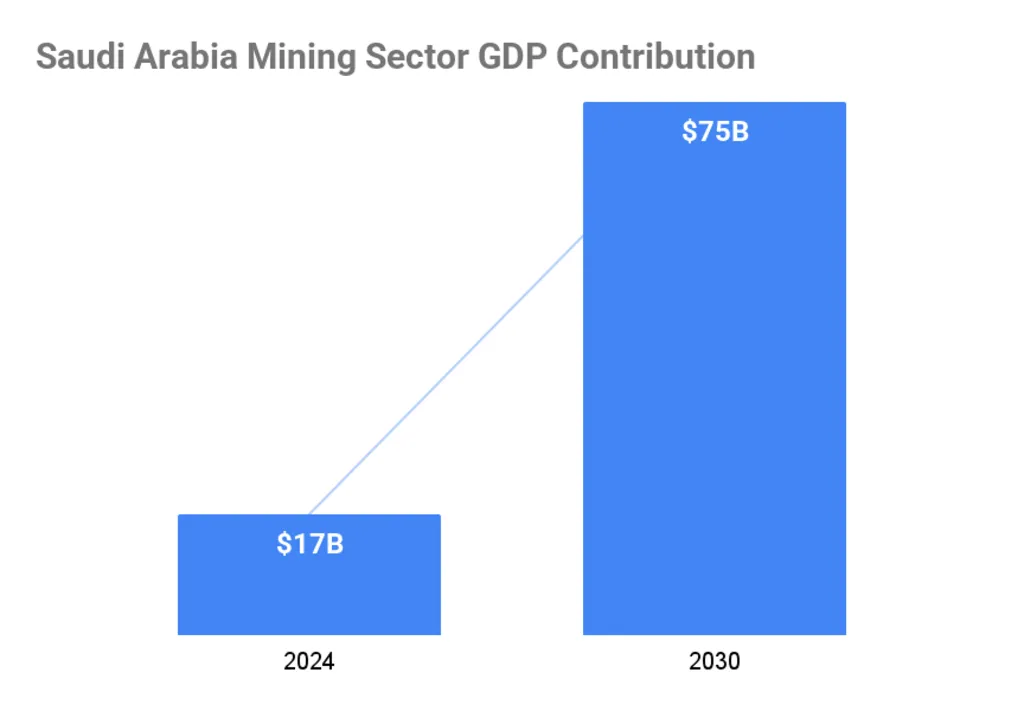

$75 Billion GDP Contribution Forecast by 2030

The long-term economic impact of Saudi Critical Minerals Exploration is transformative. The mining sector’s GDP contribution is projected to grow from $17 billion in 2024 to $75 billion by 2030. This includes:

- More than 132 active mining companies as of today (up from just 6 in 2019), with 70% foreign or JV-backed

- 1,346 industrial licenses issued in 2024

- 642 exploration licenses granted (as of end-2024)

Saudi EXIM Bank is also supporting non-oil exports, with $8.93 billion in credit facilities issued in 2024—a 103% increase year-over-year. This includes financing for mining equipment, raw material imports, and export credit insurance.

The sector is expected to generate thousands of high-value jobs, reduce import dependency (currently ~$24 billion in metals), and anchor Saudi Arabia’s transition to a post-oil economy.

Also Read: Unlocking $2.5 Trillion: Saudi Mining’s Rare Earth Revolution